To stay ahead, brokers must understand what makes their customers tick – their likelihood to purchase, cancel, and lifetime value. But how do you do it? Why are real-time customer insights so important? And how does it fit into your current tech stack?

Percayso offers a variety of services to brokers in personal and commercial lines. The team’s partnership with Close Brothers Premium Finance (CBPF) allows brokers to benefit from a cancellation model that predicts those consumers are likely to cancel their insurance early/mid-term.

In our interview series with CBPF, Percayso’s Commercial Director David Kelly joins Viktor Kazinec, Head of Analytics, to discuss the Foresight solution and its proven and tested modelling approach, the tech behind predicting customer behaviour, and how easy it is to integrate into broker rating engines via software house or direct API connections.

Percayso: Viktor, tell us about your role at CBPF!

Viktor: Thanks David! I’ve been at CBPF for 10+ years, and we’ve achieved great work during that time. I helped establish the Data Science team in 2016. Since then, we’ve been working with top personal lines brokers to model data and predict key customer behaviours that power our Foresight model.

Can you elaborate on how the Foresight model feeds in with Percayso?

Indeed, the CBPF Foresight model predicts a customer’s propensity to cancel a policy. The data for the model comes from a wide range of sources, spanning the organisation’s 30+ years of experience with brokers. The results from this stage are highly impactful – they analyse cancellation patterns, including values and timing – allowing the solution to predict the likelihood of cancellations at different stages of the policy.

We’re also discussing with Percayso the creation of a second model, an affordability score, to determine if a customer wants to expand the capability.

How often is the model refreshed?

A monthly refresh ensures that changes to customer behaviours mirror what we see in our predictions. To do this, we feed data daily into Foresight via advanced machine learning models called LightGBM and ensure the model is constantly up-to-date to provide the latest data for brokers at the point of a quote.

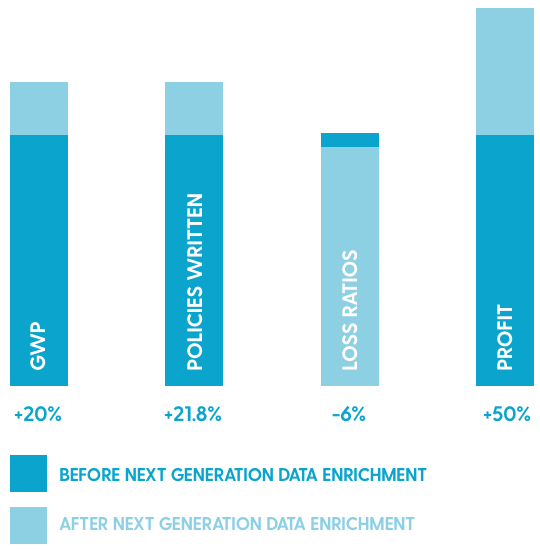

What results are typically seen by customers using Foresight?

Brokers using Foresight often see a significant reduction in cancellation rates, from over 40% to less than 20%. By using the Foresight model, brokers can leverage automation and achieve greater efficiency in adhering to regulatory requirements, such as treating customers fairly and fair value pricing. It helps brokers navigate the highly regulated environment, supporting profitability, retention and optimal premium selection.

And better decision-making, yes?

Absolutely! The model enables brokers to make informed decisions on which business to take – allowing them to charge the right amount and make strategic choices based on customer behaviour.

We’ve even seen our customers use the model to expand into new customer segments that they previously wouldn’t have targeted.

How do CBPF and Percayso work together?

We are working together to drive value for brokers. The integration process with Foresight is seamless and quick, thanks to our partnership with Percayso. Brokers can be live in weeks, leveraging Percayso’s existing integrations with various software houses.

Brokers can also connect directly via an API integration (if they want to build it themselves).

We are thrilled to partner and look forward to more developments in 2024.

So are we! I am thrilled that our [CBPF and Percayso] most recent customer, Principal, went live last month, and I can’t wait to see what we achieve together in 2024.

Want to learn more about Percayso and our partnership with Close Brothers Premium Finance? Get in touch with the team today.