How can regional brokers keep pace with data?

Percayso Inform was created three years ago by its founder Simon James, who had previously set up the first data enrichment organisation in the UK, Insurance Initiatives Ltd. Insurance Initiatives was created on the back of James noticing an opportunity within the insurance sector to harness, leverage and summarise databases in a way that is consumable for insurers and brokers. When the business was sold to LexisNexis three years ago, James felt that there was still a lot of unfinished business in the sector, according to MD of Percayso Inform Richard Tomlinson (pictured), and that there was more that he wanted to do to leverage consumers’ data and make it part of the insurance data ecosystem.

For Tomlinson, who has always worked in the sphere of data analytics and information, and who is passionate about leveraging the power of data to achieve business goals, being part of this next generation of data enrichment has been very exciting.

“There are some genuinely fascinating areas of knowledge and information,” he said, “and you find out so much about people in different places and geographies. Whether it’s about an individual person and their behaviour, or how groups of people behave in similar ways… it comes down to human behaviour and trying to predict how people work and what influences their behaviour.”

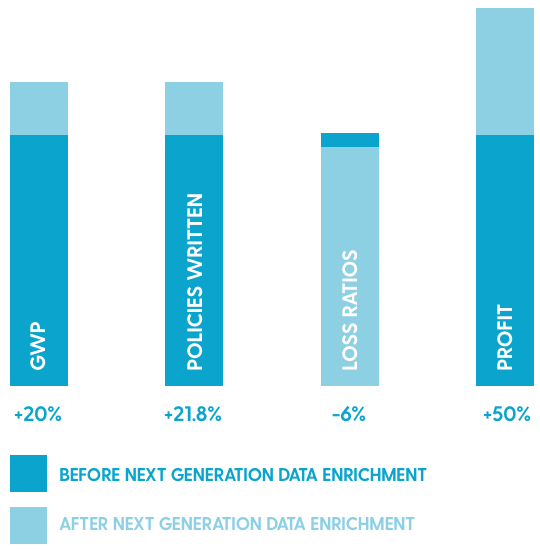

Percayso Inform is looking to new data sources, he said, to offer insurers and brokers more predictive power which in turn leads to much better outcomes with reduced claims, reduced risk, and reduced cancellations among the key benefits. Not all bureau data is the same, he said, and in order to get a 360-degree view on a customer, the insurance company needs to analyse the data of at least two or three credit bureaus plus additional data sets to understand the full risk profile of the individual.

Part of the journey for Percayso Inform, Tomlinson said, has been encouraging the consumer to input their data for their own benefit. Since GDPR came along, he said, consumers have been empowered to understand that their data does not belong to an insurance company, or to any credit bureau, but to themselves. There are personal pieces of information about the individual consumer that they should be leveraging on their own behalf, he said, and Percayso is enabling the process through which brokers and insurers can access this data – but only with the explicit consent of the consumer.

“And [the consumer] knows that by granting that access,” he said, “it will benefit them in terms of a cheaper insurance premium or a more appropriate service for their requirements.”

The growth of the data enrichment sector has been significant, Tomlinson noted, and from his discussions within the broking sector he believes that about 50% of brokers on the bigger end of the scale are utilising some form of data enrichment, and the largest are using multiple data sources in increasingly sophisticated ways. On the other end of the spectrum, smaller brokers have been slower to take up these opportunities, he said, due largely to the setup costs associated and the current lack of knowledge in this area.

“For the smaller, regional brokers who haven’t got 15 data scientists working for them, or armies of IT people,” he said, “it is harder to keep pace with all the different changes across the years. So, we have recognised that what we need to do is ‘right-size’ what we put to these brokers – we have to be flexible and not put too many barriers to entry.”

Making it easier for these brokers means not over-facing them with huge IT projects or resources or upfront costs, he said, but empathising with the position they are in and the end result that they want for their customers. Brokers can’t be experts in everything, he said – they are experts in what their core business is, not data enrichment or credit bureau data or consumer consent.

“All brokers are different,” he said, “there are some that really push the boundaries and some that are a bit more reticent and this can be dependent on historical factors such as how long the broker has been in operation or what lines of business they focus on.”

For Percayso Inform, offering the next generation of data enrichment services means doing the heavy lifting for organisations which are less familiar with the metrics involved with these services and he believes there is a real opportunity for the company to work hand in hand with these smaller brokers and to present solutions which are personalised and suitable for them.

“Handholding and guidance through that process is something we can offer them as we’re a relatively small organisation, with 22 employers, though we are growing quite rapidly,” he said. “Due to our size, we are still fleet of foot and agile and all the things that we hope will be a pleasant surprise for these businesses.”