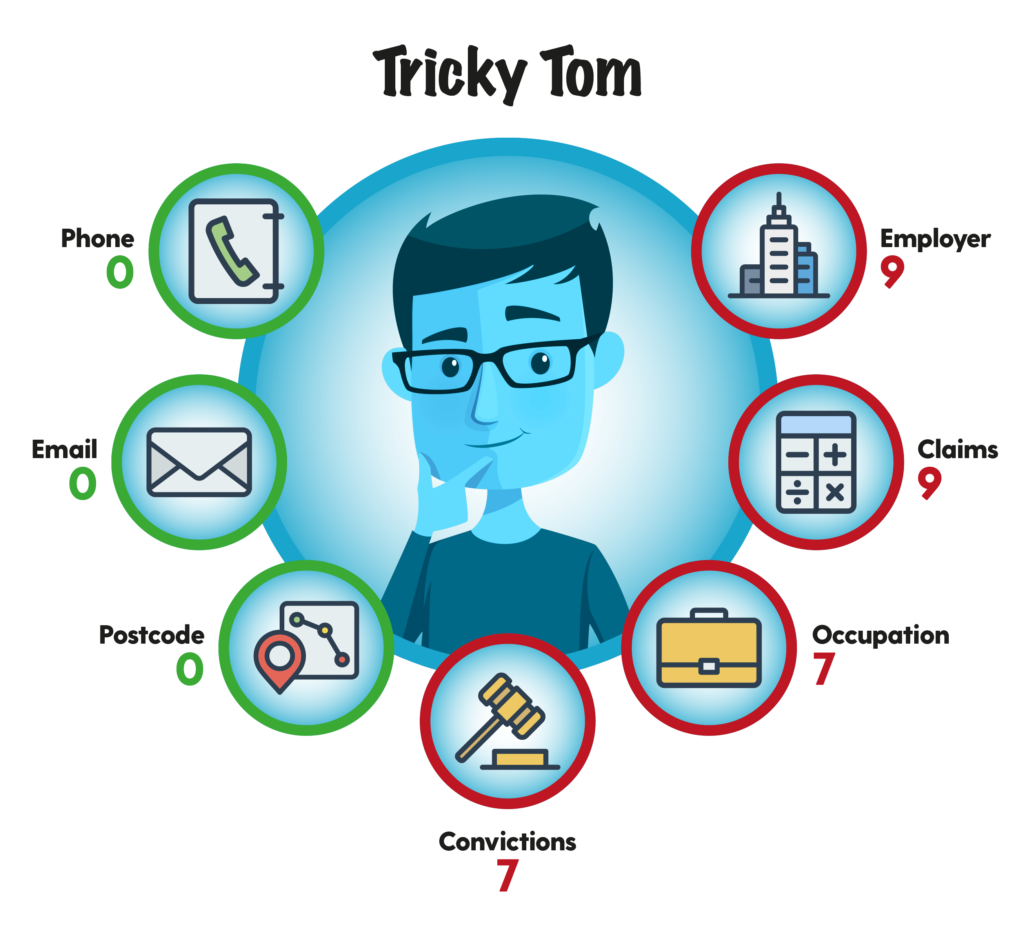

In this latest blog on quote manipulation and intelligence, we introduce Tricky Tom. Tom is a real example (anonymised obviously 🙂), based on real results, from several analytical and live projects we have undertaken with aggregator-exposed insurers and brokers.

Tom is an example of a price manipulator. That is to say, this individual has an eye on changing the fields that he knows will affect the price, leading to a lower quote. As such he is changing several fields, multiple times. For example, the number of claims nine times, his convictions seven times and his occupation seven times. The number of changes per field and the number of overall fields manipulated, alongside other factors, such as channels used and timing, strongly indicate that Tricky Tom is up to no good. Interestingly Tom is not manipulating his ID fields only those fields that he believes influence price.

The impact of this and the many individuals who are similar to Tom, is that Insurers are unknowingly insuring Tom at a much lower premium than his true risk represents, leaving them exposed to a higher level of risks, claims and fraud than they are pricing for. Unfortunately for Tom, Percayso can identify his behaviour in real-time, at quote, and enable insurers to price, or not quote accordingly. meaning Tom has to stump up the full and fair premium for his true circumstances or even end up paying more.

To find out more about quote manipulation, please contact us.