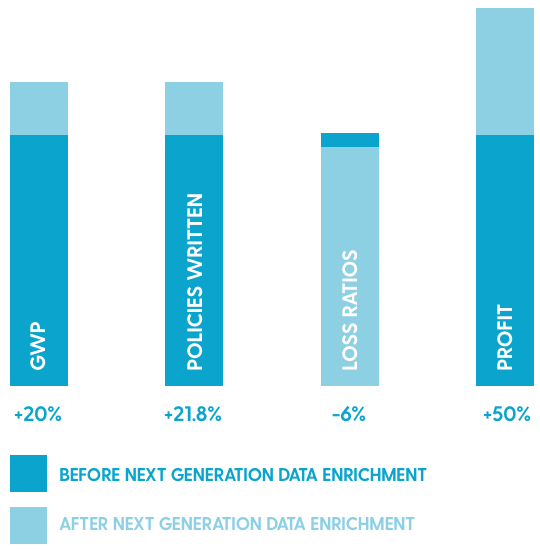

The shift to delivering slicker online quote experiences for customers has resulted in an unfortunate side effect for insurers – quote manipulation. And the bad news is that it is on the rise as some consumers become more adept at changing certain factors to their advantage.

We recently analysed manipulation across 360 million distinct quotes from the past 2 years, and found certain trends and insights we would like to share.

In this initial overview of our findings, the amount of overall ‘changes’ seems pretty high at first glance however, many of these are perfectly innocent – for example, changing your mileage by small amounts or searching on multiple cars when looking at buying a new car. The really interesting insight becomes apparent when we separate innocent changes and actual manipulation – and by that we mean providing false information to either get a cheaper premium or to ultimately commit hard fraud.

At a high level, two thirds of consumers are changing at least one factor across their quote journey but it is when we delve deeper into the manipulation and peel away the layers that we can see what is really happening beneath the surface.

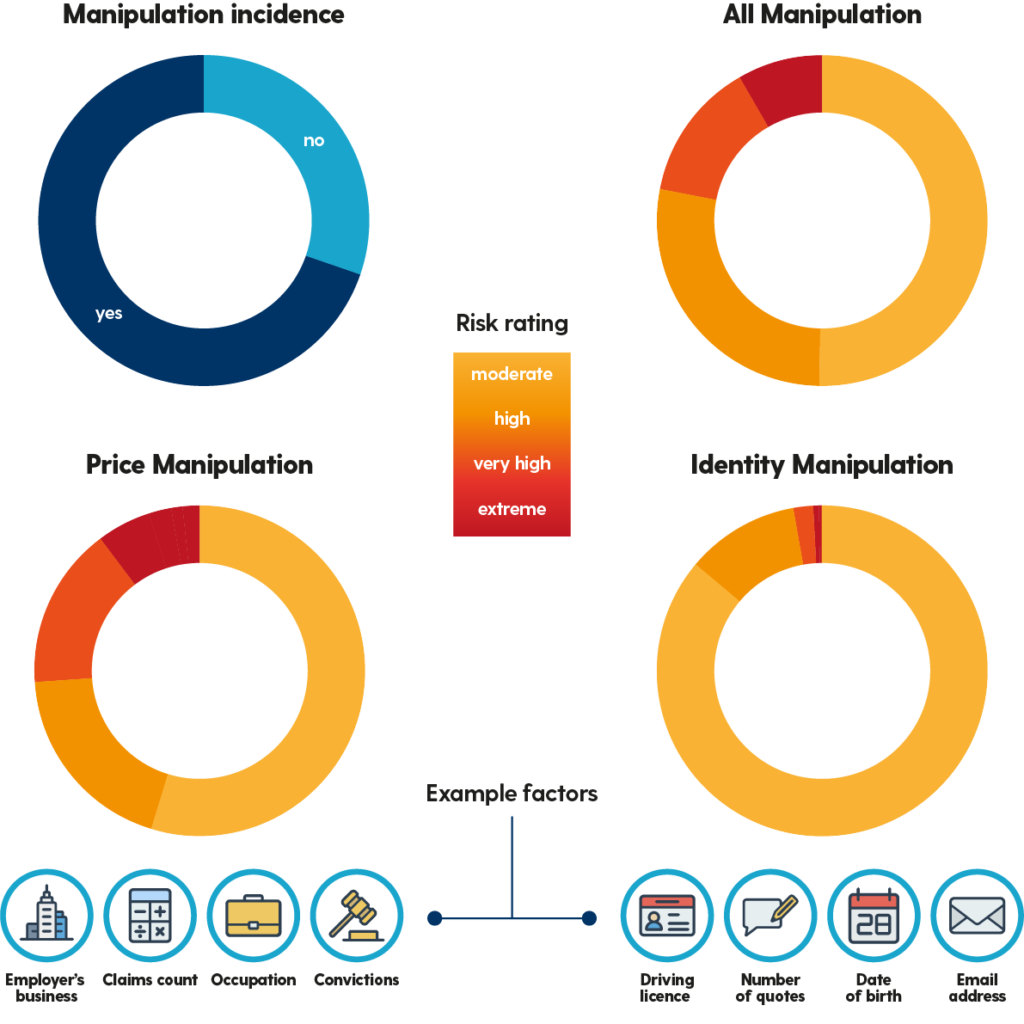

Rather than overload you with data science and to make the resulting insight easier to digest and execute on, we have graded the data in several ways – one of which is the severity of the overall manipulation. We’ve taken a number of attributes such as number of quotes, timing, the number of factors changed and by how much into account, to produce an overall risk rating.

As the charts go on to show, this can be further split down into the type of manipulation by the range of factors changed. At this level they’re split into PRICE manipulators – those who change factors that mostly affect price, such as NCD and occupation and IDENTITY manipulators – those who change factors such as DOB and email address. Clearly, there is overlap between the two and we do see a surprising number of consumers attempting to change multiple factors that affect both price and identity. All of this provides the building blocks for a successful anti-quote manipulation strategy.

We will delve deeper into each of these types of manipulation over the next few weeks, as well as the strategies that insurance providers can deploy to combat them and the technical solutions that can support this. Of course if you can’t wait and are interested in discussing our complete findings, please contact us here.